Who we are

We are Consillion. Global and independent provider of cash management solutions.

Our Products

About Us

Consillion is a global and independent provider of cash management solutions designed to help businesses minimise costs and eliminate inefficiencies around cash.

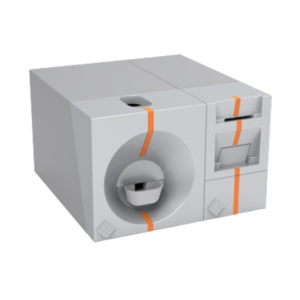

We supply a broad range of fit-for-purpose cash automation solutions either sourced by leading technology partners or designed and manufactured at our dedicated production facility in the UK. We offer a complete portfolio including self-service devices, smart safes, back office and front of store recycling systems, cash counters and sorters, and software solutions to businesses across banking, retail, hospitality, gaming, and cash in transit around the world.

Our Services

Consillion has invested heavily to create a national infrastructure to provide a full suite of services that ensure our customers receive the best after sale support and care.